The Home Loan Calculator

Get Quick Mortgage Estimates with the Home Loan Calculator. Estimate Now with the Home Loan Calculator!

Compare Mortgage Rates with the Home Loan Calculator

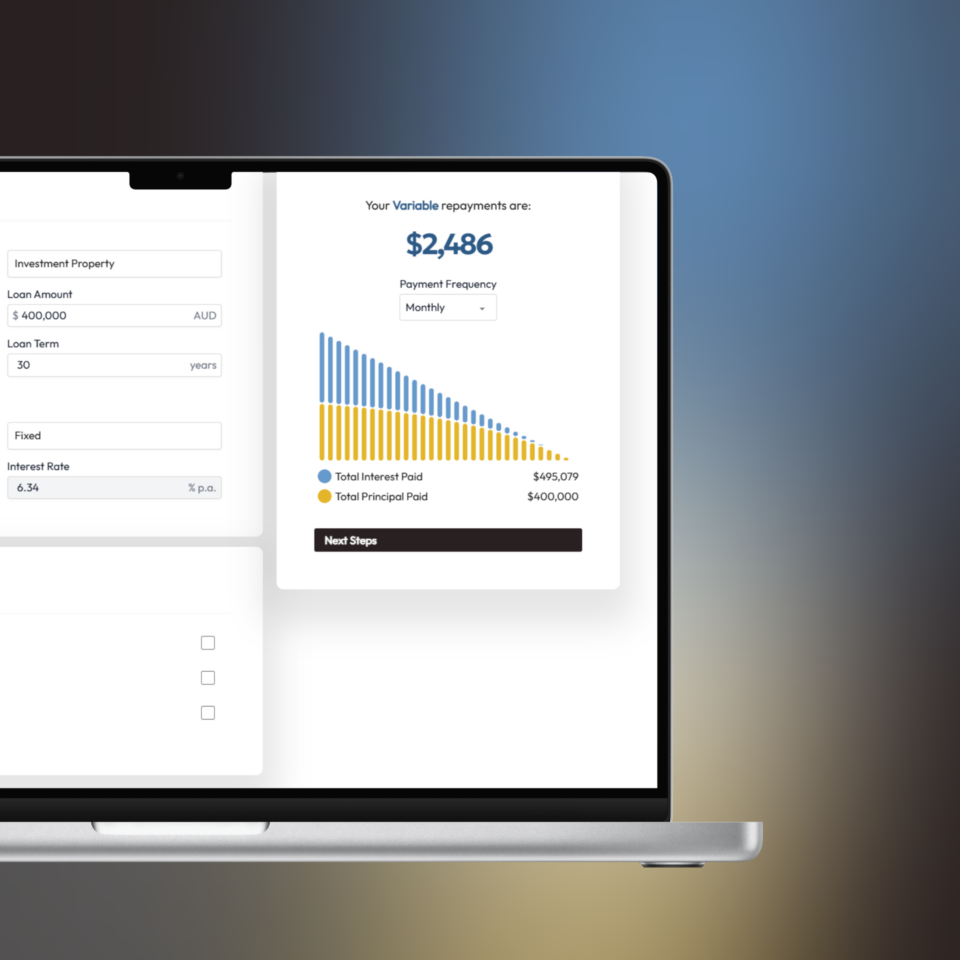

No need to guesstimate when making what could be one of the most important decisions of your life – buying property with a mortgage. Making sense of mortgage rates is easy when the rate is changed into repayment estimates for your specific property and borrowing amount.

We have incorporated the latest technology into our device to enable property buyers to quickly obtain more accurate and reliable estimates on which to proceed to the next stage of property ownership.

Calculate loans based on variable and fixed rates for any borrowing amount. You can use any interest rate sourced from a bank or lender to compare. Use our current mortgage rates to generate estimates and see how competitive we can be in the market.

For your specific best rate, contact our mortgage experts or request a quote.

Simplify the process of finding the best rates in Australia’s large mortgage market by using our expert services. We secure the most competitive rates from a vast selection of more than 80 lenders by matching specific customer profiles with the most suitable lenders. Our large lender coverage and personal service enables property buyers to quickly secure the best mortgage rate from the bank or other lender that is aligned with their needs. Calculate your estimates with our competitive rates and request a quote for the best mortgage rate we can secure for you.

- Quickly compare mortgage rates across the market.

- Easily calculate fixed and variable rate mortgage products.

- Access competitive mortgage rates from 80+ lenders.

Read more...

Put rates and house prices into repayment context with our mortgage estimator. Quickly obtain repayment estimates based on different interest rates and different borrowing amounts to make comparisons and assist with crucial property buying decisions.

It’s simple to use, free-to-use, and can estimate mortgage repayments on many types of property loans.

Get your estimates now, and for quotes and competitive rates based on your specific requirements, speak with our mortgage experts.

Versatile, Practical - The Home Loan Calculator for All Mortgage Estimates

While browsing houses for sale, quickly compare the prices shown based on mortgage payment estimates. Our device has the versatility to calculate estimates based on prices for all types of properties in the residential market. Providing prospective buyers with estimates on which to compare the affordability of different properties. Start comparing house prices now or request a quote!

Preparing a budget to build a house, renovate an existing property or purchase a land and house package can be complicated. Using our lending estimating device allows property owners and buyers to work out how much they can afford to spend and set their budget accordingly. Work out repayments for construction loans to advise designers and builders of the budget they have to work with. Make decisions on inclusions in packages where multiple options with finishes and extras are available. Convert a quote from a builder into loan repayments to make decisions on proceeding or requesting variations. Construction loans can include many options so contact us to discuss the right product to suit your building project.

Key to purchasing investment properties can be the return which the investor can expect to receive. Returns from rent need to be evaluated against the costs incurred by the investor in purchasing and maintaining the property. The calculation device enables investors to obtain rough estimates on mortgage payments. The interest rates and deposits on loans for investment properties vary from those available for owner-occupiers. Our latest mortgage rates may be used for estimation purposes and our experts are available for a discussion on your property investment plans and what financing solutions we can secure for you.

The deposit plays a crucial role in property loans as the size of the deposit can affect the interest rate offered. Buyers that do not have the standard 20% deposit, may be eligible for low deposit house loans with a 5% to 10% deposit. These types of loans may attract a higher rate and can also include the requirement for Lender Mortgage Insurance (LMI). The calculation device may be used to obtain estimates for assessing options and a discussion with our experts can quickly clarify your eligibility for a low deposit mortgage and provide a quote.

The versatility of our mortgage calculation device means it can be used to estimate many different types of housing loans including refinancing and Home Equity Loans. When it’s time to review your mortgage at the end of a fixed rate term, save time requesting offers from multiple lenders, by quickly calculating your own quick estimates to compare. Want to consider using equity in your property as the collateral to refinance or invest? Calculate estimates and speak with our property finance experts for the most affordable opportunity we can secure for you.

Compare House Prices based on Estimated Mortgage Repayments

While browsing houses for sale, quickly compare the prices shown based on mortgage payment estimates. Our device has the versatility to calculate estimates based on prices for all types of properties in the residential market. Providing prospective buyers with estimates on which to compare the affordability of different properties. Start comparing house prices now or request a quote!

Prepare Budgets for New Builds, Renovations, Land and House Packages

Preparing a budget to build a house, renovate an existing property or purchase a land and house package can be complicated. Using our lending estimating device allows property owners and buyers to work out how much they can afford to spend and set their budget accordingly. Work out repayments for construction loans to advise designers and builders of the budget they have to work with. Make decisions on inclusions in packages where multiple options with finishes and extras are available. Convert a quote from a builder into loan repayments to make decisions on proceeding or requesting variations. Construction loans can include many options so contact us to discuss the right product to suit your building project.

Evaluate Estimate Returns on Investment Property

Key to purchasing investment properties can be the return which the investor can expect to receive. Returns from rent need to be evaluated against the costs incurred by the investor in purchasing and maintaining the property. The calculation device enables investors to obtain rough estimates on mortgage payments. The interest rates and deposits on loans for investment properties vary from those available for owner-occupiers. Our latest mortgage rates may be used for estimation purposes and our experts are available for a discussion on your property investment plans and what financing solutions we can secure for you.

Assess Low Deposit Housing Loans Options

The deposit plays a crucial role in property loans as the size of the deposit can affect the interest rate offered. Buyers that do not have the standard 20% deposit, may be eligible for low deposit house loans with a 5% to 10% deposit. These types of loans may attract a higher rate and can also include the requirement for Lender Mortgage Insurance (LMI). The calculation device may be used to obtain estimates for assessing options and a discussion with our experts can quickly clarify your eligibility for a low deposit mortgage and provide a quote.

Review Refinancing and Home Equity Lending Options

The versatility of our mortgage calculation device means it can be used to estimate many different types of housing loans including refinancing and Home Equity Loans. When it’s time to review your mortgage at the end of a fixed rate term, save time requesting offers from multiple lenders, by quickly calculating your own quick estimates to compare. Want to consider using equity in your property as the collateral to refinance or invest? Calculate estimates and speak with our property finance experts for the most affordable opportunity we can secure for you.

Obtain Useful, Helpful Property Mortgage Numbers with The Home Loan Calculator

- Compare mortgage payments on different priced properties.

- Generate practical mortgage figures to support buying decisions.

- Compare building quotes, establish a renovation budget.

- Supporting property investors – assess ROI.

- Calculate useful estimates to evaluate your options.

How to Use the Home Loan Calculator in 3 Quick Steps

The property mortgage market may be large, and the range of loan types complicated. But working out mortgage estimates using our device is simple. No specialised knowledge of the mortgage sector is required. Estimates can be generated by all property buyers with 3 quick online moves.

Enter the amount required for the mortgage, the interest rate and the term available for that particular rate. Borrowing limits may be determined by lenders after an assessment of the application. For estimating purposes, use the property price and deduct the deposit you intend to make. Use our current rates to get started with your estimating.

With the figures entered in the designated boxes, the estimated monthly repayment is displayed. To get an estimate for a different property price or at a different rate, simply change the figures. It’s that quick and it’s that easy. Start getting your estimates and be 3 quick steps further along on your path to property ownership.

- User-friendly mortgage repayment calculator.

- Online format, 24/7 access.

- Flexible functionality – enter the figures you choose.

Follow-up Using the Home Loan Calculator with Our Mortgage Experts

Estimates can be extremely helpful in the initial stages of buying a property. To follow-up those estimates and be closer to buying your property, have a discussion with one of our mortgage experts. We’ll source the right mortgage product from the right lender at the most competitive interest rates. Our experts are highly skilled and experienced in sourcing and structuring property finance to suit individual buyer requirements.

With our experts to assist, the application process is simplified and extremely straightforward. You provide the required financials and details, and our experts will handle your mortgage requirements. Supporting you through the process from your initial enquiry through to settling on your property. Request a mortgage consultation with us and confidently move closer to buying your property.

Most Frequently Asked Questions About Mortgages

Does the home loan calculator estimate refinancing mortgages?

Yes. Mortgage calculation devices are generic in nature and can be used to generate estimates to be used as guides for different loans including refinancing. To estimate refinancing mortgages, enter the applicable rate and terms for the lender and/or finance product being considered.

What is LMI?

LMI stands for Lender Mortgage Insurance. This is an insurance policy which a lender takes out on loans with lower deposits, usually less than 20%. Loans with 5-10% deposits are seen as higher risk lending to lenders. LMI is their assurance of recouping the funds extended should the borrower default. The lender has the policy, but the borrower covers the costs in the fees applied by the lender.

What deposit will I need to be eligible for a home mortgage?

Residential property mortgages for owner-occupiers typically require a deposit of 20%. Borrowers may be approved with 5-10% deposits. Lower deposit mortgages usually attract an extra cost with Lender Mortgage Insurance. Investors may be approved with a deposit less than 20%. A mortgage application will need to be submitted to a lender to confirm approval of borrowing limits and deposits.

How do I work out repayments with different deposits on the home loan calculator?

To obtain estimated mortgage payments with different deposits using an online calculation device, simply deduct the deposit from the borrowings required. Enter the amount required for the mortgage less the deposit. Change the amount entered to calculate repayments based on a different deposit.

Can the home loan calculator be used for investment property loan estimates?

Yes. Investment property loans can be estimated using online calculation devices. Investors should note the interest rate for investment properties to enter into the device. Interest rates on investment property mortgages can differ from owner-occupier rates. By entering the relevant rate, borrowing required and term, the estimated repayment can be calculated.

What interest rate do I use with the home loan calculator?

Online mortgage calculating devices are generic in functionality and can be used with any interest rates. Users can enter rates they have sourced from different lenders. Ensure the rate selected applies to the type of mortgage product required. Calculators can be used with both fixed and variable rates.

Can first home buyers use the home loan calculator?

Yes. Online mortgage tools do not differentiate between users. They are formatted to generate estimates purely on the numbers that are entered by the user. First property buyers should ensure they select the appropriate lending product and interest rate to enter to generate estimates to use as a guide.

What is the maximum property price that the home loan calculator handles?

Lenders may have limits on property prices they will finance, and individual borrowing limits are determined by lenders. But online calculating tools typically do not have limits, unless specifically stated by the provider of the device.

How do I estimate a land and house package with the home loan calculator?

Where a house and land package is being financed as a single acquisition, mortgage repayment estimates may be calculated using the total price minus the deposit. Where the land and house are separate purchases, different loans may be required. Subject to lender approval.

Let Yes Home Loans simplify the process by taking care of the complicated steps for you